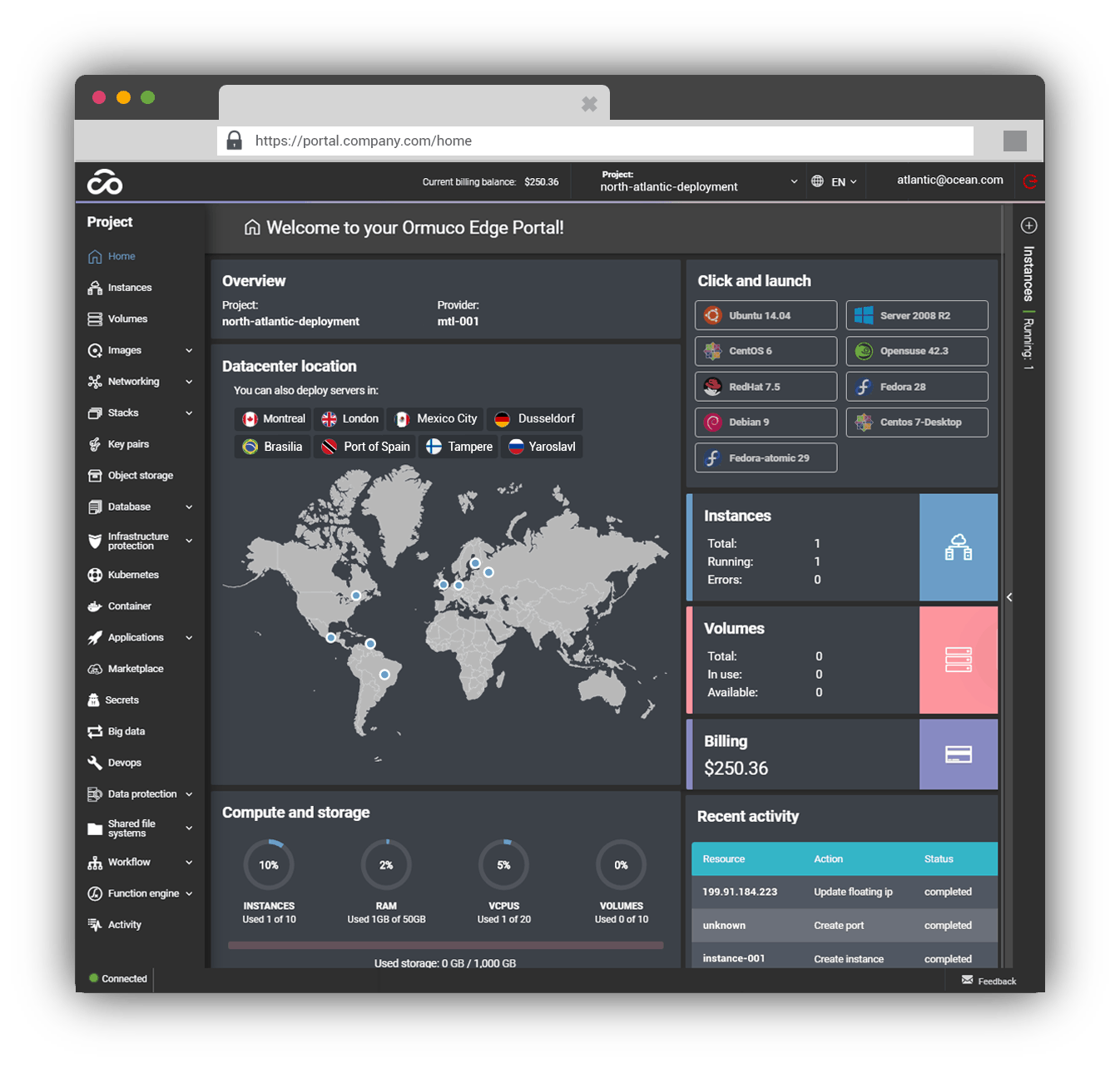

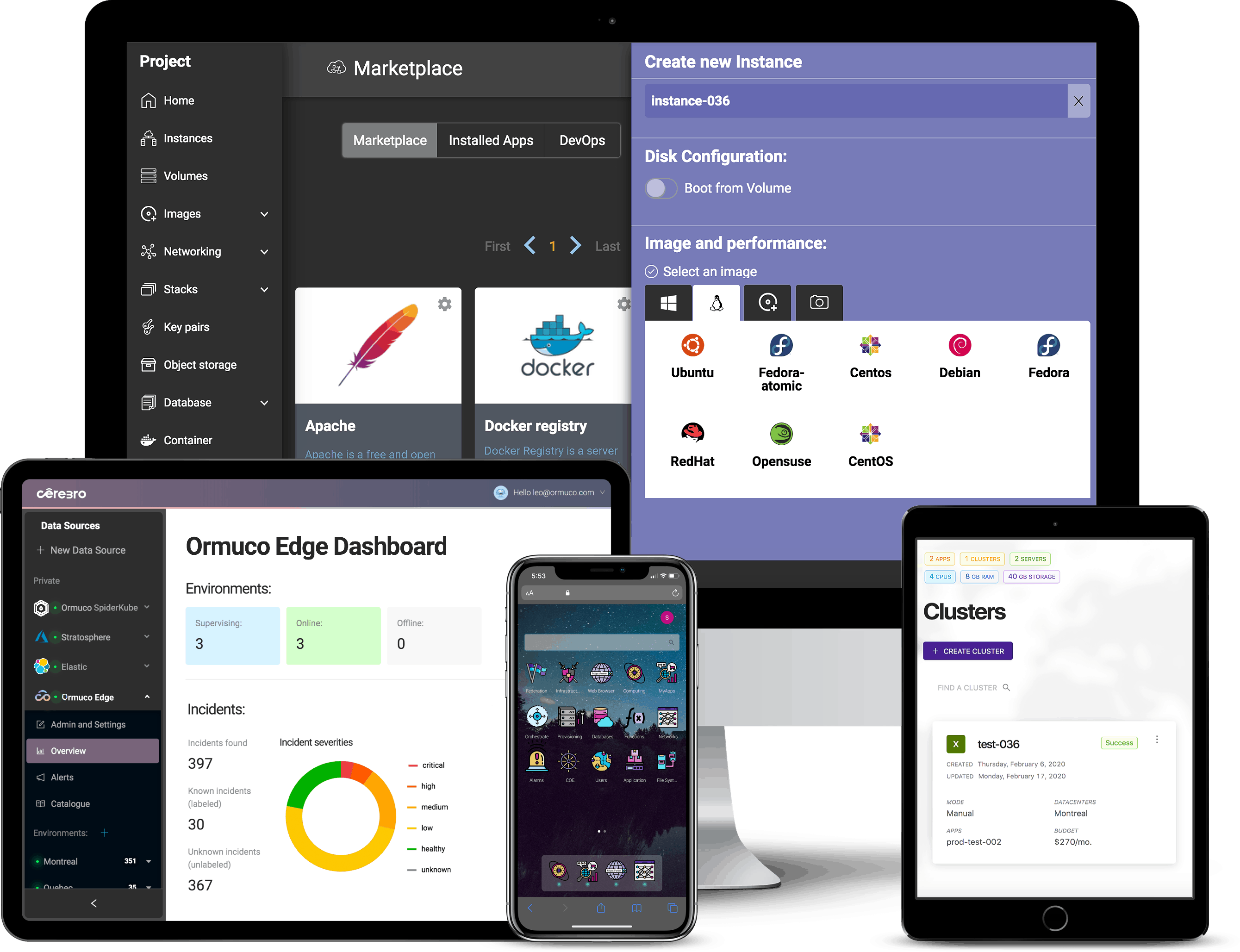

- Spawn workloads and applications in containers or virtual machines to any edge node, globally or locally.

- Serve users from the optimal geographical location.

- Self-heal with automated incident identification and resolution.

- Unleash true speed with our 5G-ready platform.

Get Everything You Need to Deploy Edge-Native Services

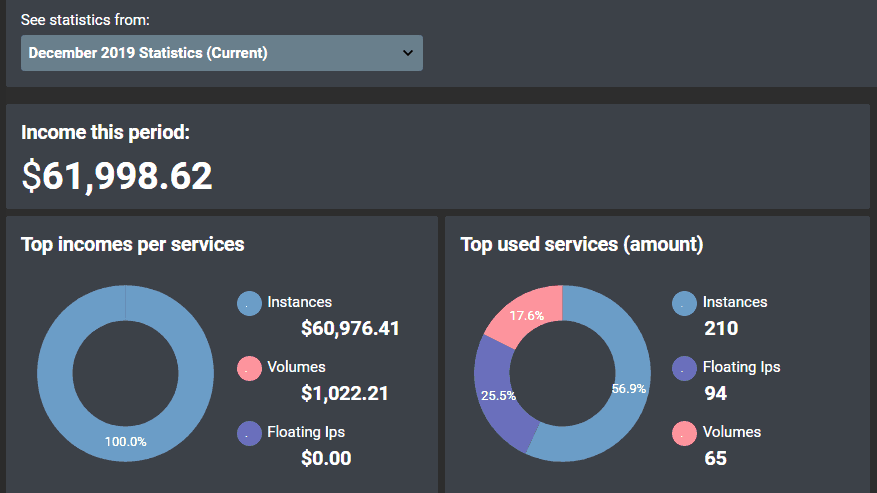

Ormuco turns idle infrastructure into compute nodes for developers to deploy dynamic workloads. Our edge computing solutions make application delivery more efficient for enterprise and consumer users.